Describe the Three Major Components of a Cash Flow Statement

Describe the three major components of a cash flow statement. Net cash used in financing activities Net increase in cash and cash equivalents 123 Add Cash and cash equivalents at beginning of the period.

Statement Of Cash Flows How To Prepare Cash Flow Statements

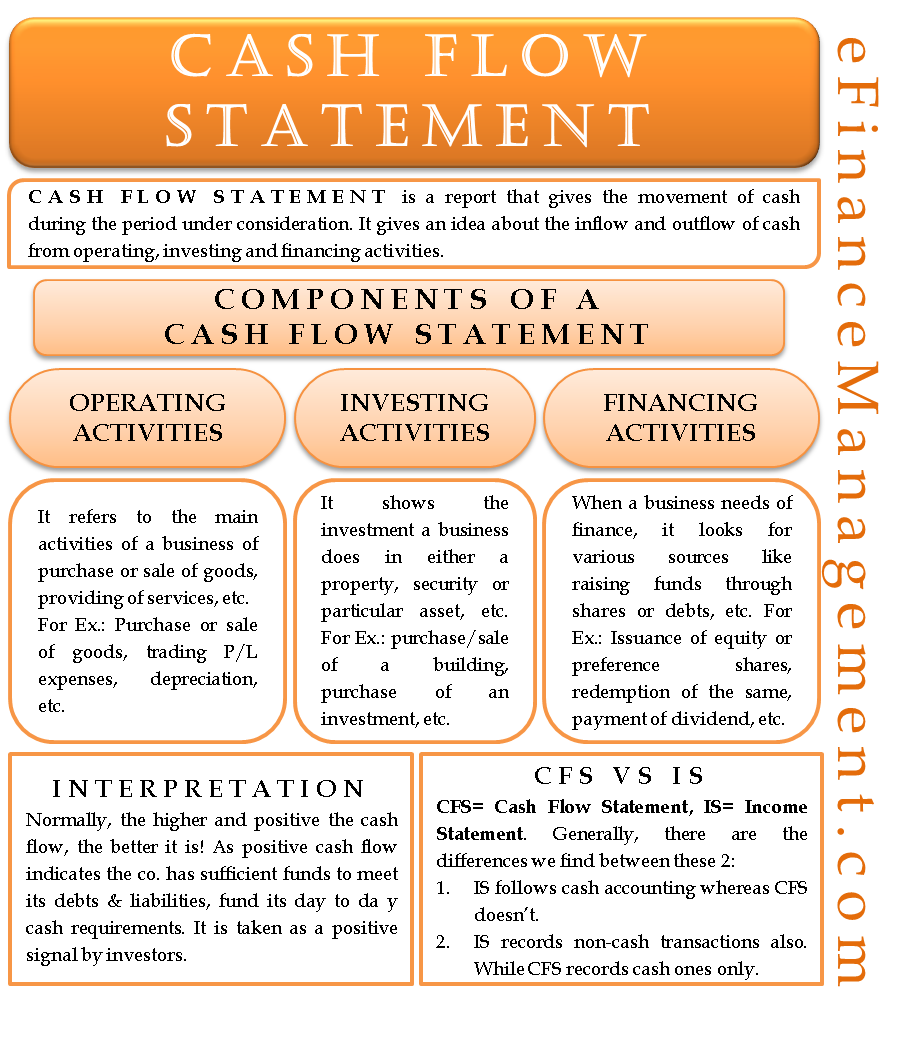

What are the three types of cash flows presented on the statement of cash flows.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

. The three sections of the cash flow statement includes Cash from operating activities. Cash flows from financing activities Proceeds from issue of share capital Proceeds from long-term borrowings Payment of long-term borrowings Interest dividends paid 3. Operating investing and financing are the three major classifications of activities in a cash flow statement.

Net Cash Flow Total Cash Inflows Total Cash Outflows Cash Flow from Operations Cash Flow from Investing Cash Flow from Financing. Components of cash flow statement 1. Cash from investing activities.

The two methods of calculating cash flow are the direct method and. Basically it is the operating income plus non-cash items. COMPONENTS OF CASH FLOW STATEMENT 2.

Operating investing and financing activities. MEANING OF CASH FLOWS STATEMENT. The net cash-flow is computed as.

After all you dont have investments and youre running your business with credit cards and a small line of credit. Cash from financing activities. Shows the financial position of a business.

The three primary sections of a statement of cash flow or cash flow statement. Cash Flow from Operating Activities. The cash flow statement components provide a detailed view of cash flow from operations investing and financing.

Components of the Statement of Cash Flows. Cash flow statement is one important financial statement that provides detailed summary of cash inflows and outflows. A operating activities include adjustments to net income for items that do not affect cash for example changes in inventory accounts receivable accounts payable losses or gains on.

This includes credit items and begins with purchasing inventory on credit selling on credit paying for the inventory and collecting the credit items. Small Business Management 16th Edition Edit edition Solutions for Chapter 10 Problem 9DQ. Expressed as a snapshot or financial picture of the company at a specified point in time ie as of December 31 2017 Has three sections.

Cash Flow Yield measuring how much cash a business generates per share relative to its share price expressed as a percentage. Inflows outflows and net flows are items of information in the statement of cash flows. A summary of the actual or anticipated incomings and outgoings of cash in a firm over an.

The cash flow statement has 3 parts. When analyzing cash flow two points in time are taken into consideration. These consist of Operating Financing and Investing.

Describe the three major components of a cash flow statement. The net amount of cash coming in or leaving from the day to day business operations of an entity is called Cash Flow From Operations. Operating activities investing activities and financing activities.

It is important to know exactly how much cash is generated in the normal course of operating a business on a daily basis. Assets liabilities and shareholders equity. Cash flows are classified as operating investing or financing activities on the statement of cash flows depending on the nature of the transaction.

Revenues expenses and net income are elements of the income statement. The main components of the CFS are cash from three areas. There can also be a disclosure of non-cash activities.

A cash flow statement summarizes the transactions for a specified periodcash generating activities and activities requiring cash expenditure. The three sections of a cashflow statement are cashflow from operations cashflow from investing and cashflow from finan View the full answer. The cash items at the beginning and at the end of the period in accordance to the companys balance sheet for the respective times.

The cash flow statement has three components. The three sections of a cash flow statement are. Cash Flow Statement Components.

Which items are recorded as operating investing and financing activities on the statement of cash flows. These are sections for operating activities investing activities and financing activities. Cash flow from operating activities cash flow from financing activities cash flow from investing activities.

When a company buys or. Significant non-cash investing and financing transactions must also be disclosed. Cash Flow Per Share CFPS cash from operating activities divided by the number of shares outstanding.

Each of these three classifications is defined as follows. Standard cash flow statements will be broken into three parts. Assets Liabilities Shareholders Equity.

There are three major cash flow activities in each business. Describe the three major components of a cash flow statement. Operating investing and financing.

Youve heard these terms before but youre not clear about how they appear in your small business. Operating investing and financing. Three major components of the cash flow statement are operating activates investing activities and financing activities.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Comments

Post a Comment